PERS – Retirees – Fees for non-compliant reporting

As a reminder, please be aware that the California Public Employees’ Retirement System (CalPERS) is assessing fees for retiree non-compliant reporting. While this message contains a lot of information with supporting documentation, please know that the main points are:

* Follow the rules for hiring a CalPERS retiree. * Pay retirees in the month they work. * In Escape a Retire must be identified as “Member Type R” to properly report compensation and hours worked. * Every month before Submitting Payroll, log into the my|CalPERS system to validate retiree Appointment dates and compensation reporting to avoid fees.

If you have general questions about CalPERS retirees and how to access retiree data in CalPERS please call:

* Myron Porter 805-964-4711 x 5280 * Staci Hunter 805-964-4711 x 5254

You may also contact:

* The CalPERS Customer Contact Center at 1-888-225-7377.

________________________________

Fees – $200 for each non-compliant occurrence may include:

* Late Enrollment – applies to the timely inputting of beginning and ending Appointment dates. * Late Payroll – reporting of compensation must take place during the month the retiree works. * Missing Payroll – Once there is a beginning Appointment date, CalPERS expects the reporting of compensation every month until an ending Appointment date is input. If no end date is input, the non-reporting of a retiree’s expected compensation is considered a “Missing Payroll.” * Improper pay rates for the performance of temporary, limited-duration work. * Retirees must be identified as “Member Type R” in Escape to properly report compensation and hours worked.

District Action:

* Follow the mandated rules for hiring and reporting a retiree. See attached CalPERS documentation.

* Consequences of improper hiring and reporting may result in fees or require the retiree to reinstate and pay contributions for work already performed. Reinstatement of a Classic (2% at 55) retiree would cause this individual to become a PEPRA (2% at 62) member and be subject to a different retirement formula. CalPERS cannot apply PEPRA compensation toward Classic service and vice versa.

* Critical → Pay retirees during the month their work is performed. For instance, the retiree works in September. Make payment for the September reporting period using the September Regular, October Supplemental or by manual warrant processing that is available during the first few days in October.

* Update records in the my|CalPERS system on a monthly basis. Reconcile CalPERS identified potential “Missing Payroll” information. Complete this task prior to Submitting Payroll for the month to avoid CalPERS imposed fees of $200 for each non-compliant occurrence.

* The my|CalPERS system allows districts to run reports for reviewing open-ended appointments with no earnings for retirees and other employees that may have intermittent work. Resolving discrepancies includes:

* Promptly inputting beginning and ending Appointment dates for a retiree in both the my|CalPERS and Escape systems. * Verifying no reportable earnings for the pay period for a retiree. If it is likely a retiree will have intermittent and reoccurring work during the year, a district may choose the option of confirming “No Earnings” for a given month in the my|CalPERS system. Confirmation of “No Earnings” is not meant to be an indefinite action by a District.

* The Payroll Team is available to help districts navigate within my|CalPERS system to locate and run the Projected Contributions Detail Report to reconcile whether CalPERS expects the reporting of retiree compensation and deposit of contribution for the month. Districts may use this report or go to the Retirement Appointment Reconciliation screen in the my|CalPERS system to address missing Appointment information or verify “no earnings” for the reporting period.

* Closely monitor retires for how many hours they work to stay within the 960-hour limitation.

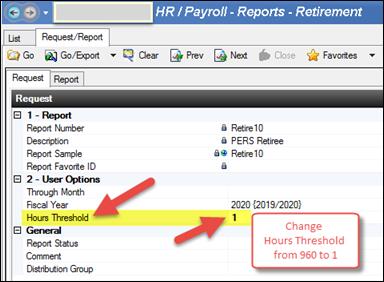

* Use the Escape Retire10-PERS Retiree report to monitor hours. As a suggestion, change the default of 960 hours to 1 hour in the “Hours Threshold” field before ordering the report.

* SBAS collects CalPERS assessed fees using a journal voucher for each applicable District. This method is similar to the CalSTRS Penalties and Interest journal voucher, with backup documentation attached identifying the retiree. The general account code 01-0000-0-0000-7200-5800-000-0000-0000 will appear on the journal voucher. Please move the CalPERS fees from this account to your District’s desired account (some districts may use the retiree’s payroll account as a starting point).

________________________________ Examples:

* The retiree: * Has a July 1 beginning Appointment date. * There is no compensation reported for July.

$200 fee – July Based on the July 1 beginning appointment date, CalPERS expects to have compensation reported for the July reporting period. Because no compensation was reported for July, CalPERS will assess a $200 fee for Missing Payroll data.

* The retiree: * Has a July 1 beginning Appointment date. * Works in July and has compensation reported in July. * Does not work again until November.

No fee – July A fee is not applied because there is a July 1 beginning Appointment date and reporting of compensation takes place in July. $200 fee – August $200 fee – September $200 fee – October CalPERS will assess a $200 Missing Payroll fee for every month compensation is expected and not reported. This will occur until an ending Appointment date is input into the my|CalPERS system.

* An employee’s Appointment date history:

* Hire date as an “Active Member” is March 1, 1993. * Beginning Appointment date is March 1, 1993. * Last day worked is December 30, 2018. * Ending Appointment date is December 31, 2018. * Hire date as a Retiree in a “Retired Annuitant Position” is July 8, 2019. * Beginning Appointment date as a Retiree is July 8, 2019. * The same month the temporary, limited-duration work is complete, an ending Appointment date must be input into the my|CalPERS system. The ending Appointment date is the day after the last day worked. For instance, last day worked is October 15, 2019 and the ending Appointment date is October 16, 2019.

________________________________

Attached, please find information from CalPERS:

* Enrolling and Reporting Retired Members – August 2, 2018 * Enrolling and Reporting Retired Members – March 30, 2018 * Post Service Retirement Employment Requirements – January 14, 2014 * Employer Checklist for Hiring CalPERS Retirees Effective January 1, 2013

Key points from the attached documentation:

* “An employer shall enroll a retired member within 30 days of the effective date of hire or a fee of $200 will be assessed per month until the retired annuitant is enrolled in my|CalPERS.” * “CalPERS retirees cannot be hired into permanent or regular staff positions without reinstatement from retirement. Retirees should be hired into retired annuitant-designated positions only. These appointments are authorized during an emergency to prevent stoppage of public business or because the retiree has skills needed to perform work of limited duration.” * “Limited duration does not mean an indefinite appointment to a permanent part-time position.”

________________________________

Regards,

School Business Advisory Services Team Santa Barbara County Education Office

Please do not reply to this email. This is an unattended mailbox.