Preliminary Fair Market Value (GASB 31)

Dear School Business Officials,

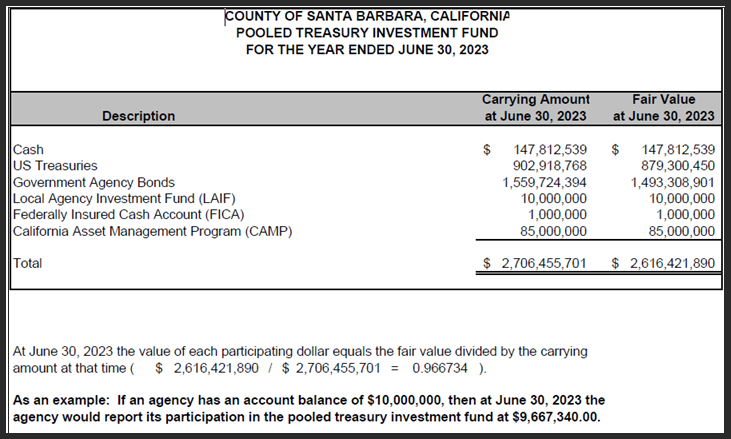

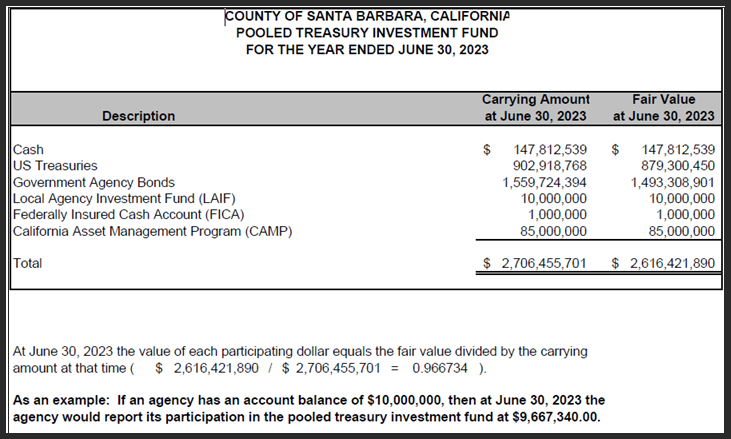

Below, please find the preliminary calculation from the Santa Barbara County Treasurer-Tax Collector of Fair Market Value (FMV) as of June 30, 2023. We are providing the preliminary numbers to allow districts time to review the calculations with your auditors and post your FMV entries in Escape prior to completing the Year End Soft Close. Once the Santa Barbara County Treasurer-Tax Collector provides the formal GASB 31 letter, it will be posted on the SBAS Website, Audit<sbasweb.sbceo.org/reporting/audit> page.

Below, please find the preliminary calculation from the Santa Barbara County Treasurer-Tax Collector of Fair Market Value (FMV) as of June 30, 2023. We are providing the preliminary numbers to allow districts time to review the calculations with your auditors and post your FMV entries in Escape prior to completing the Year End Soft Close. Once the Santa Barbara County Treasurer-Tax Collector provides the formal GASB 31 letter, it will be posted on the SBAS Website, Audit<sbasweb.sbceo.org/reporting/audit> page.

As an external participant of the Santa Barbara County Pooled Treasury Investment Fund, your district will need the fair market value to prepare your financial statements in accordance with Statement 31 of the Governmental Accounting Standards Board (GASB) for the year ended June 30, 2023.

Please contact your Auditor or District Financial Advisor with any questions regarding posting FMV adjustments as part of the Year End Close process.

Regards,

School Business Advisory Services Team Santa Barbara County Education Office

Note: This message was sent on behalf of the School Business Advisory Services Team. Please do not respond to this message. Replies will be routed to an unmonitored mailbox.

To unsubscribe, click here<mailto:sbasfinance@sbceo.org?subject=Unsubscribe>

Below, please find the preliminary calculation from the Santa Barbara County Treasurer-Tax Collector of Fair Market Value (FMV) as of June 30, 2023. We are providing the preliminary numbers to allow districts time to review the calculations with your auditors and post your FMV entries in Escape prior to completing the Year End Soft Close. Once the Santa Barbara County Treasurer-Tax Collector provides the formal GASB 31 letter, it will be posted on the SBAS Website, Audit<sbasweb.sbceo.org/reporting/audit> page.

Below, please find the preliminary calculation from the Santa Barbara County Treasurer-Tax Collector of Fair Market Value (FMV) as of June 30, 2023. We are providing the preliminary numbers to allow districts time to review the calculations with your auditors and post your FMV entries in Escape prior to completing the Year End Soft Close. Once the Santa Barbara County Treasurer-Tax Collector provides the formal GASB 31 letter, it will be posted on the SBAS Website, Audit<sbasweb.sbceo.org/reporting/audit> page.As an external participant of the Santa Barbara County Pooled Treasury Investment Fund, your district will need the fair market value to prepare your financial statements in accordance with Statement 31 of the Governmental Accounting Standards Board (GASB) for the year ended June 30, 2023.

Please contact your Auditor or District Financial Advisor with any questions regarding posting FMV adjustments as part of the Year End Close process.

Regards,

School Business Advisory Services Team Santa Barbara County Education Office

Note: This message was sent on behalf of the School Business Advisory Services Team. Please do not respond to this message. Replies will be routed to an unmonitored mailbox.

To unsubscribe, click here<mailto:sbasfinance@sbceo.org?subject=Unsubscribe>