Payroll Alert: New employee – not new to PERS or STRS

[Banner, Header, Attention, Caution, Warning, Note]

Payroll Alert – CalPERS & CalSTRS New hire does not always mean new to a retirement system Classic vs. PEPRA member

Over the past few years, we have seen an increase in errors based on the placement of newly hired employees into the wrong retirement formula or benefit structure for either the California Public Employees’ Retirement System (CalPERS) or State Teachers’ Retirement System (CalSTRS).

Establishing employees in the correct retirement formula or benefit structure dictates many important factors such as contribution rates, types of compensation subject to retirement, and potential retirement allowance. Adjustments for erroneous reporting are time consuming and can result in fees or penalties and interest. Please use the following guidelines and refer to the examples below for every new hire:

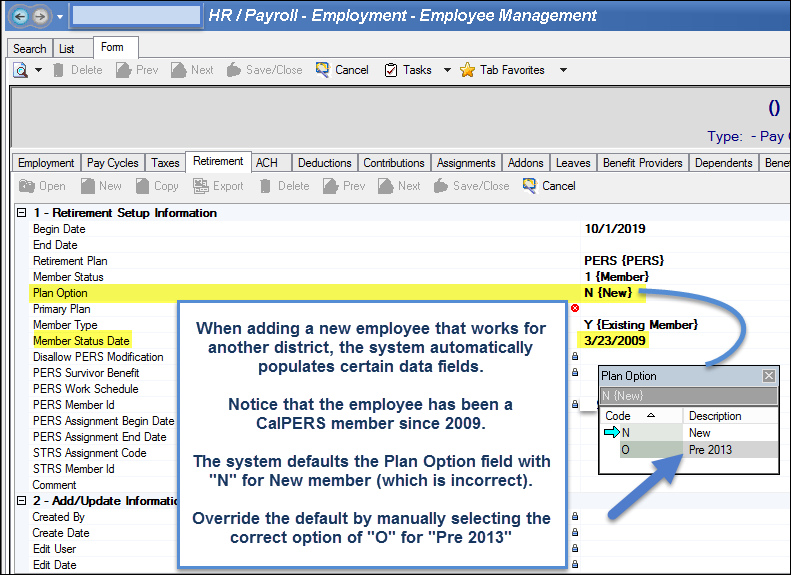

* A new hire does not always mean the employee is a new member of CalPERS or CalSTRS. Districts often hire employees that are already members of CalPERS or CalSTRS.

* CalPERS and CalSTRS have different formulas and benefit structures for retirement coverage that are dependent on specific dates, December 31, 2012 and January 1, 2013. See example below.

* Before adding any new employee into the Escape HR/Payroll modules, always verify retirement membership status and correct formula or benefit structure.

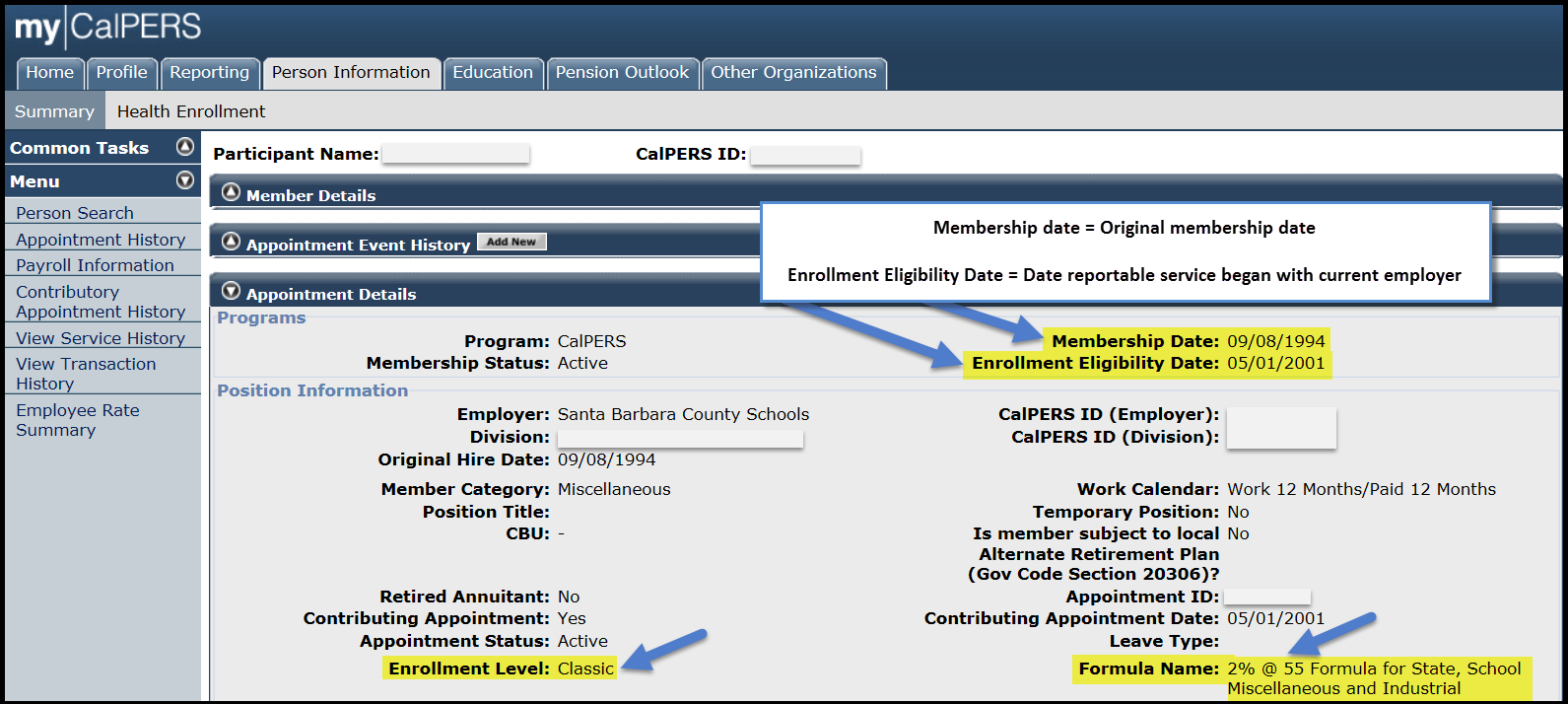

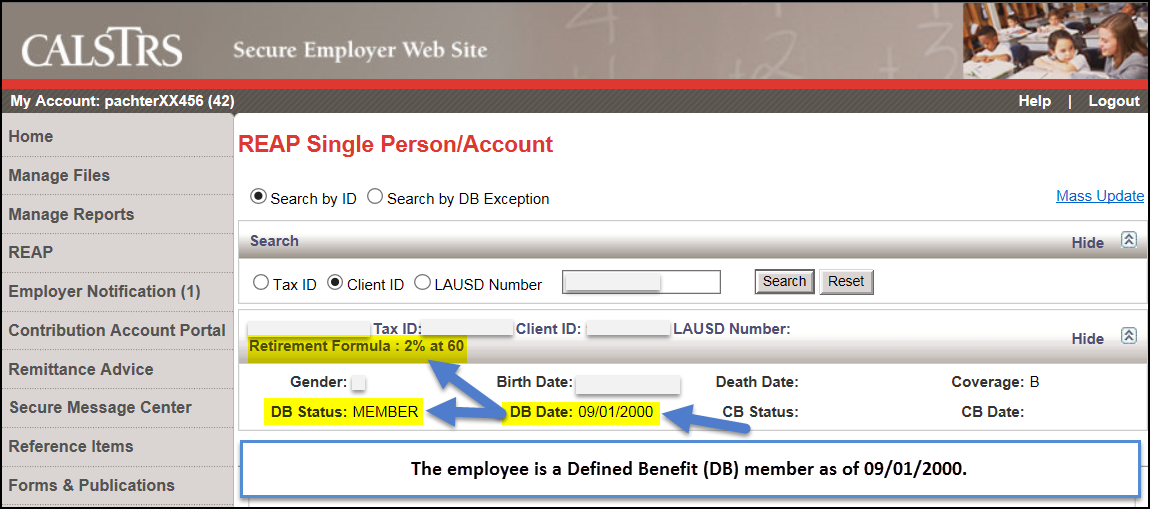

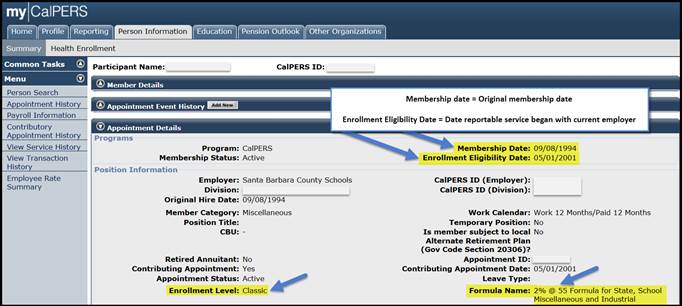

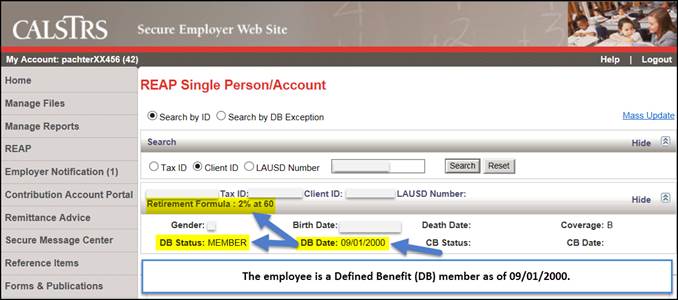

* Log into either CalPERS or CalSTRS software (see examples below) to validate:

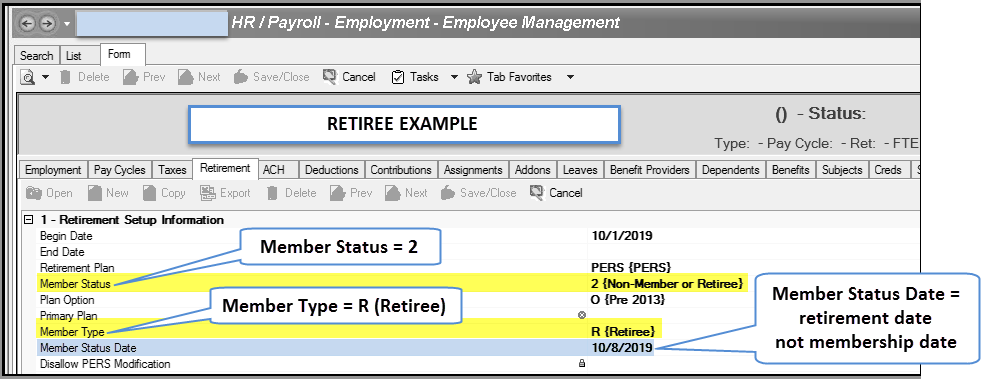

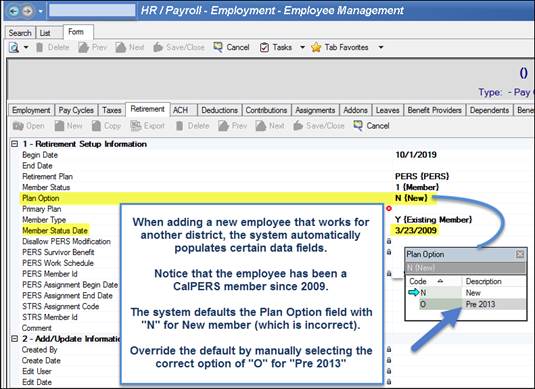

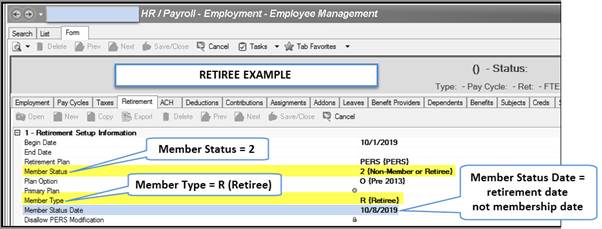

* Member, Non-member, New member, or Retiree status. * Already a member – Validate original membership date, ID number, and Classic or PEPRA status. Input or compare this information to what is in the Escape system for correctness. * Non-member – Validate non-member status and monitor hours worked toward mandatory membership. * New member – Input applicable data into the CalPERS or CalSTRS system for membership. Obtain their membership ID number and input the number into the Escape system. * Retiree – All retirees must be identified in CalPERS or CalSTRS as a retiree; update retirement system records if necessary. All retirees must also be identified as a retiree in Escape with Member Type = R. See example below.

For questions about this subject or how to look up membership status and formula or benefit structure in the CalPERS or CalSTRS software, please contact the Payroll Team:

* Myron Porter mporter@sbceo.org<mailto:mporter@sbceo.org> 805-964-4711 x 5280

* Staci Hunter shunter@sbceo.org<mailto:shunter@sbceo.org> 805-964-4711 x 5254

* Richard Weger rweger@sbceo.org<mailto:rweger@sbceo.org> 805-964-4711 x 5242

* Sheng Xiong sxiong@sbceo.org<mailto:sxiong@sbceo.org> 805-964-4711 x 5252

Example – Retirement Formulas and Benefit Structures

CalPERS

CalSTRS

Member on or before 12-31-2012.

Formula sometimes called: 2% at 55 CLASSIC Pre 2013 (Escape system identifier) Old (Escape system identifier)

Members first hired to perform service that could be creditable to the DB plan on or before 12-31-2012.

Benefit structure sometimes called: 2% at 60 CLASSIC Pre 2013 (Escape system identifier) Old (Escape system identifier)

Member on or after 1-1-2013.

Formula sometimes called: 2% at 62 PEPRA New (Escape system identifier)

Member first hired to perform service that could be credited to the DB plan on or after 1-1-2013.

Benefit structure sometimes called: 2% at 62 PEPRA New (Escape system identifier)

Example – Escape system – New hire, already a member of PERS

Example – Escape system – Retiree designation

Example – My|CalPERS – Person Information – Appointment Details

Example – CalSTRS SEW REAP – Validate membership and Retirement Formula

Regards,

School Business Advisory Services Team Santa Barbara County Education Office

Please do not reply to this email. This is an unattended mailbox.