Dear School Business Professionals,

[Text, calendar Description automatically generated] The Year-End Close webpage<

www.sbceo.org/domain/293> is available with the SBAS Year-End Close Calendar<

sbas.sbceo.org/Escape/FiscalYearEndCalendar.2023.pdf>, Checklist<

sbas.sbceo.org/Escape/DistrictYECloseCheckList.22-23.pdf> and a variety of other materials to assist you. It is our intent to expand this page to include additional resources in the future, so please continue to check back for updates.

* Survey – Due July 19th We are requesting districts to complete a brief Year-End Close Planning survey<forms.office.com/r/gu1xd1Tqhb> to indicate the date the Unaudited Actuals Report will be going to the board along with available virtual support sessions from a Year-End Close expert. * Year-End Close Checklist – When completed, please use the File Upload<sbas.sbceo.org/docs/fileuploads.shtml> function on the SBAS website to upload a copy of the completed checklist<sbas.sbceo.org/Escape/DistrictYECloseCheckList.22-23.pdf> along with all the listed reports to SBAS for review and processing. * Year-End Close Manual – We have continued developing a district Year-End Close Manual<sbas.sbceo.org/Escape/DistrictFiscalYearEndCloseManual.2023.pdf> to assist you with the closing process. A draft of the manual can be accessed from the webpage in the Toolbox section and will be expanded upon in future years. * Soft Close – Due August 31st Below are general steps and important reminders related to the submission of your Soft Close Checklist Package to our office: Step 1: After you finish the year-end work in Escape and you are ready to Soft Close the district’s General Ledger, please review the checklist and organize your documents for submission.

* Reminder…the district needs to have the SELPA office review the SEMA/SEMB calculation and forms to ensure they are completed correctly. If they are not completed correctly, this could affect your Maintenance Of Effort (MOE). All districts need to complete this form even if the district has nothing to report — the contact name and phone number must be completed.

Note: You may submit your package to SBAS prior to approval from SELPA. Once you receive approval, please forward the SEMA/SEMB forms with the email approval from SELPA via the File Upload<sbas.sbceo.org/docs/fileuploads.shtml> function on the SBAS website. Step 2: Submit all your documents (for approval) via the File Upload<sbas.sbceo.org/docs/fileuploads.shtml> function on the SBAS website.

* When the soft close documentation is submitted to SBAS, our staff conducts a review of the submission documents checking for any errors and omissions as a service to our districts. This preview helps mitigate any potential errors for districts when completing Unaudited Actuals in the SACS software. This is the reason why the due date is August 31. Our staff works our way through an internal review checklist which can take up to 1-2 days to review the entire submission. Then, if anything is identified that needs to be adjusted by the districts, this provides a window of opportunity for our staff to notify districts and for districts to make changes prior to completion of the Unaudited Actuals. Step 3: After you receive an approval email from the SBAS finance team stating that your soft-close is approved, move forward with completing the Unaudited Actuals in SACS.

* Reminder: In order to ensure that what is reported in the district’s Unaudited Actuals matches your general ledger exactly, districts need to have an approved soft close from SBAS prior to the Unaudited Actuals submission to the board. No further changes should be made in Escape after the Unaudited Actuals are presented to the board in mid-September.

* Unaudited Actuals Report – Due Sept. 15 (board approved) It’s our goal to make this process as smooth as possible. If you have any questions, please contact our Finance Team:

Daisy Lazaer, Financial Analyst, 805-964-4711 x5295 Chris Rhodes, Financial Analyst, 805-964-4711 x5226 Alejandro Baeza, Finance Systems Supervisor, 805-964-4711 x5372

Regards,

School Business Advisory Services Team Santa Barbara County Education Office

Note: This message was sent on behalf of the School Business Advisory Services Team. Please do not respond to this message. Replies will be routed to an unmonitored mailbox.

Visit our website: www.sbceo.org/sbas<www.sbceo.org/sbas>

To unsubscribe, click here<mailto:sbasfinance@sbceo.org?subject=Unsubscribe>.

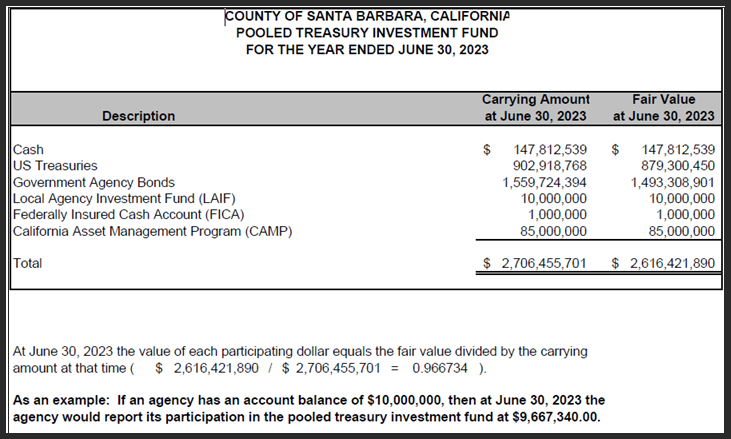

Below, please find the preliminary calculation from the Santa Barbara County Treasurer-Tax Collector of Fair Market Value (FMV) as of June 30, 2023. We are providing the preliminary numbers to allow districts time to review the calculations with your auditors and post your FMV entries in Escape prior to completing the Year End Soft Close. Once the Santa Barbara County Treasurer-Tax Collector provides the formal GASB 31 letter, it will be posted on the SBAS Website, Audit<

Below, please find the preliminary calculation from the Santa Barbara County Treasurer-Tax Collector of Fair Market Value (FMV) as of June 30, 2023. We are providing the preliminary numbers to allow districts time to review the calculations with your auditors and post your FMV entries in Escape prior to completing the Year End Soft Close. Once the Santa Barbara County Treasurer-Tax Collector provides the formal GASB 31 letter, it will be posted on the SBAS Website, Audit<